The sales journal record all the sales and the payments made in chronological order. A cash receipts journal is used to record all cash receipts of the business.

Cash Receipts Journal Fundsnet

A credit sale of an asset is recorded in general journal.

. An easy way to understand journal entries is to think of Isaac Newtons third law of motion which states that for every action there is an equal and opposite reaction. Cash Receipts Journal CRJ The cash receipts journal is the journal where you record all cash that has been received. Single-entry accounting is more like using a checkbook than an accounting journal although businesses will still want to keep receipts and the details about their financial transactions.

This is cash received from any source - from income a loan received a debtor etc. Create Receipt Accounting Distributions. Businesses use an Accounts receivable Journal to record these credit sales.

Examples of journals include the Cash Receipts Journal CRJ and the Cash Payments Journal CPJ. Account Receivable is an account created by a company to record the journal entry of credit sales of goods and services for which the amount has not yet been received by the company. The details of a journal entry.

Create accounting distributions for receipts of accrue at receipt purchase orders. The journal altogether shows the combined value of all the credit sales and money owed by the customers of the business. The cash receipts journal manages all cash inflows of a business organization.

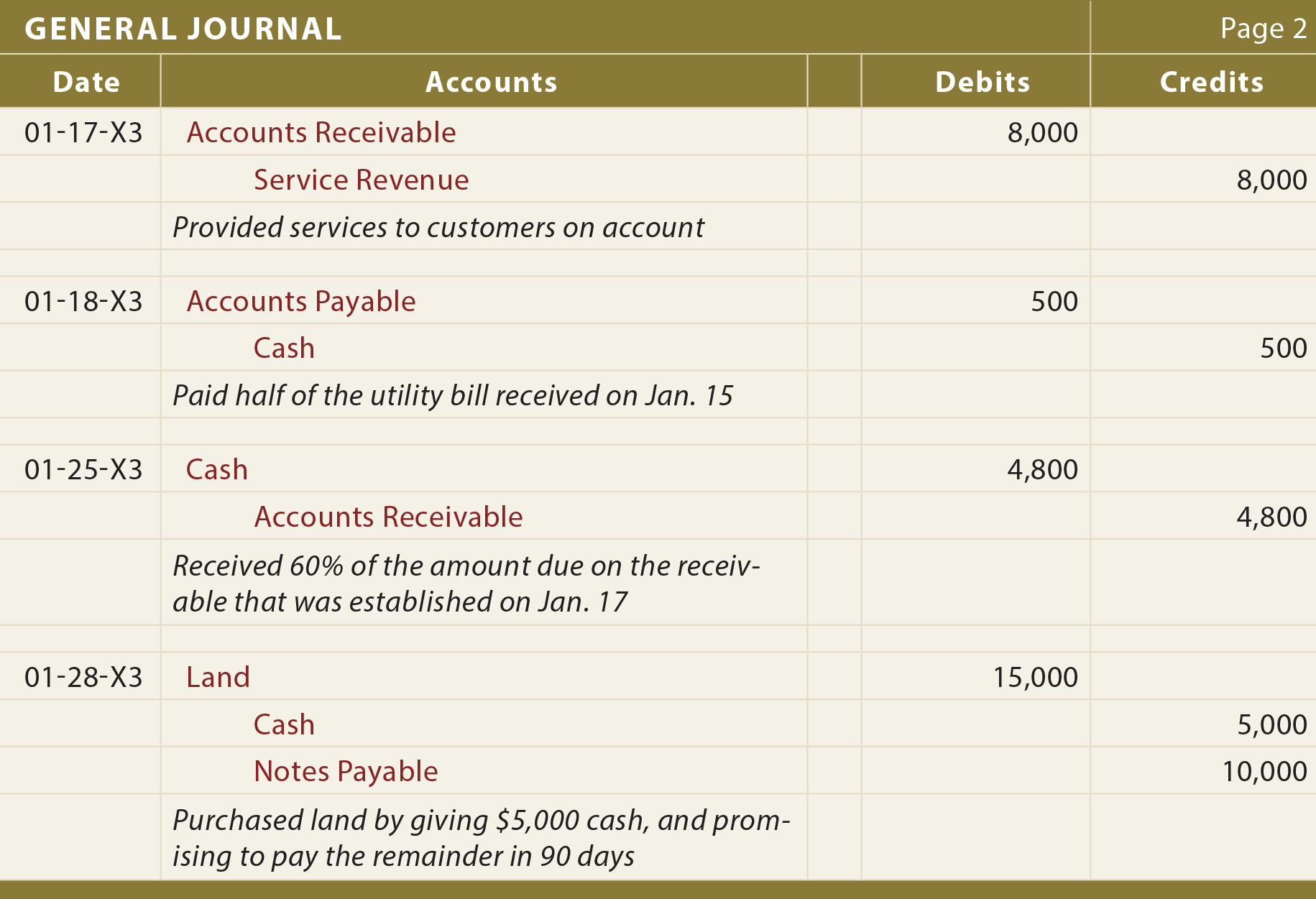

An accounting journal entry is the method used to enter an accounting transaction into the accounting records of a business. Of course these days bookkeepers enter transactions in an accounting program on the computer. Apart from the general journal accountants maintained various other journals including purchases and sales journal cash receipts journal and cash disbursements journal.

In other words this journal is used to record all cash coming into the business. Anytime money comes into the company the. A narration where you can enter something like Business expense paid with personal funds.

The accounting records are aggregated into the general ledger or the journal entries may be recorded in a variety of sub-ledgers which are later rolled up into the general ledger. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. A cash receipt journal is an accounting journal that keeps a record of all cash transactions made by a business.

It used to be an actual book that the bookkeeper would use to make accounting entries. All cash received by a business should be reported in the accounting records. A date - use either the date of the transaction or the last day of the month in which the transaction occurred.

Most businesses use double-entry accounting systems for. The special journal used for recording all types of cash receipts is called the cash receipts journal. For example if a company bought a car its assets would go.

Sales journal is used for recording the credit sale of merchandise only. The cash receipts journal is a special journal used to record the receipt of cash by a business. The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account.

It is also the primary accounting journal. The journal transaction window will include. Sales journals are a special type of accounting book which are mainly used to track sales receipts and much more.

The cash receipts journal is used to record all receipts of cash for any reason. For recording all cash outflows another journal known as cash disbursements journal or. Before computerized bookkeeping and accounting the transactions were entered manually into a journal and then posted to the general ledger.

The Accounts Receivable journal is the first book of accounting for recording an entry when a credit sale is made. The format of each journal is shown below along with a description. In a cash receipts journal a debit is posted to cash in the amount of money received.

See also Understanding Goodwill in Balance Sheet -. Oracle Fusion Receipt Accounting is used to create manage review and audit purchase accruals. The cash receipts journal should always have an other column to record amounts which do not fit into any of the main categoriesAt the end of each accounting period usually monthly the cash receipts journal column totals are used to update the general ledger accounts.

A debit account - select the account that reflects the type of expense put a description of the item purchased. The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. So these books of first entry are now just in digital form.

The journal is simply a chronological listing of all receipts including both cash and checks and is used to save time avoid cluttering the general ledger with too much detail and to allow for segregation of duties. It includes the following features. So whenever a transaction occurs within a company there must be at least two accounts affected in opposite ways.

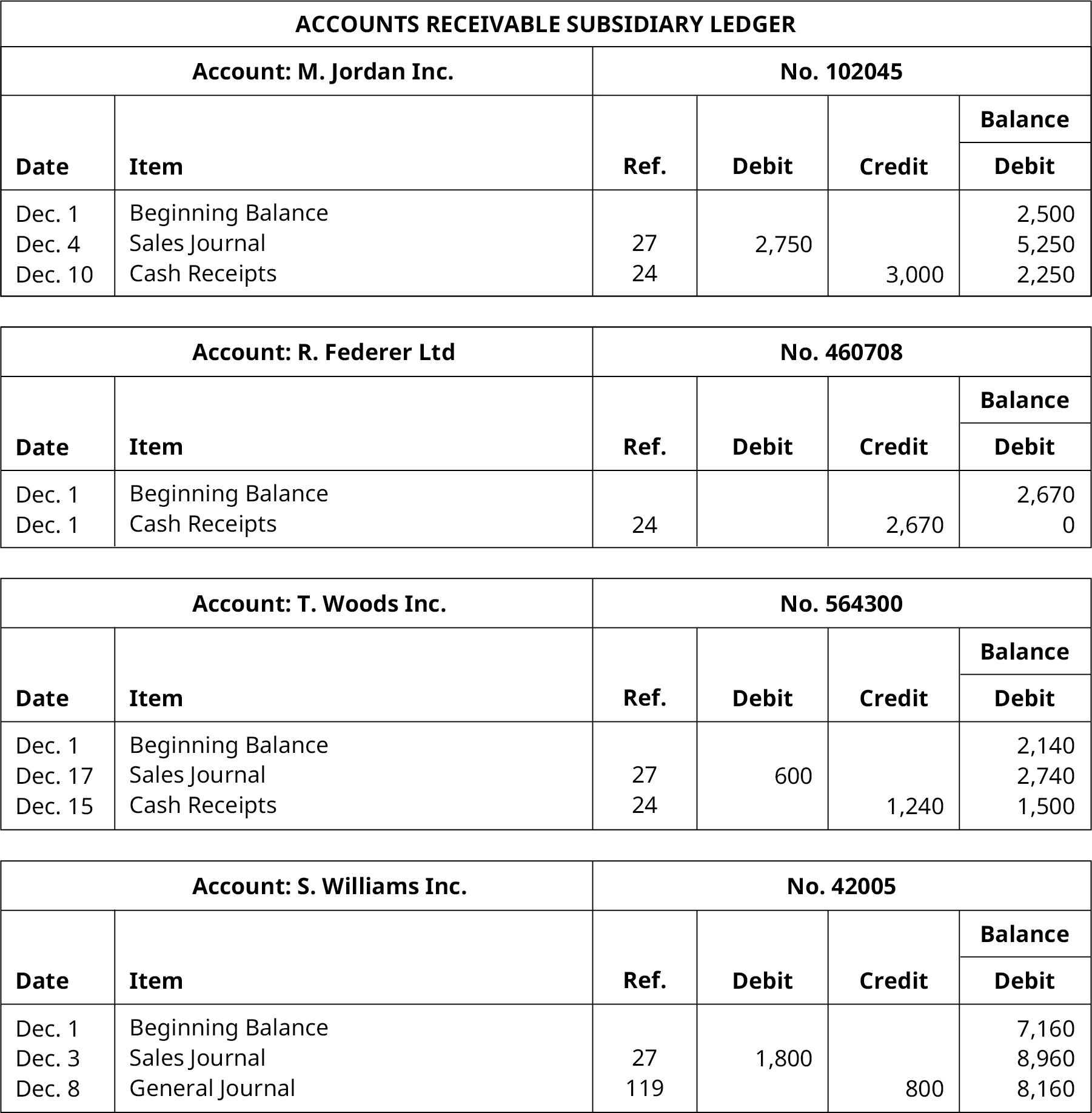

Cash sale of merchandise is recorded in the cash receipt journal. It follows the rules of cash accounting and records a transaction as and when it completes. The subsidiary customer ledgers would be updated daily but at the end of the period the TOTALS only would be recorded in posted directly into the accounts listed with no journal entry necessary.

Describe And Explain The Purpose Of Special Journals And Their Importance To Stakeholders Principles Of Accounting Volume 1 Financial Accounting

0 Comments